For example, many savings and loan institutions compound interest daily. This means that interest is calculated on the beginning balance of your account on each day. Interest is payment for the use of money for a specified period of time. Interest can be calculated on either a simple or a compound basis. The Rule of 72 helps you estimate how long it will take your investment to double if you have a fixed annual interest rate.

What is the approximate value of your cash savings and other investments?

When you borrow money, you will have to pay interest as well as paying back the original amount. The interest charged on it is for the principal and accumulated interest. So you need 14.87% interest rate to turn $1,000 into $2,000 in 5 years. And it is also possible to have yearly interest but with several compoundings within the year, which is called Periodic Compounding. A simple-interest loan becomes a compound-interest loan any time the interest due isn’t paid.

Example: you have $1,000, and want it to grow to $2,000 in 5 Years, what interest rate do you need?

Thus, the compound interest rate formula can be expressed for different scenarios such as the interest rate is compounded yearly, half-yearly, quarterly, monthly, daily, etc. TD Bank has issued a loan of $2,000 to a sole proprietor for a period of 5 years at an interest rate of 7%. If $70,000 are invested at 7% compounded monthly for 25 years, find the end balance.

Solve the compound interest formula A = P(1 + i)n for P

If compound interest is to be added over a large number of years, the calculation becomes very long and complex. Amelia borrows \(£1500\) at a compound interest rate of \(8\%\) per annum (p.a.). Every year, \(7.5\%\) of \(£250\) will be added as interest to Saoirse’s account.

Compound Interest: Start Saving Early

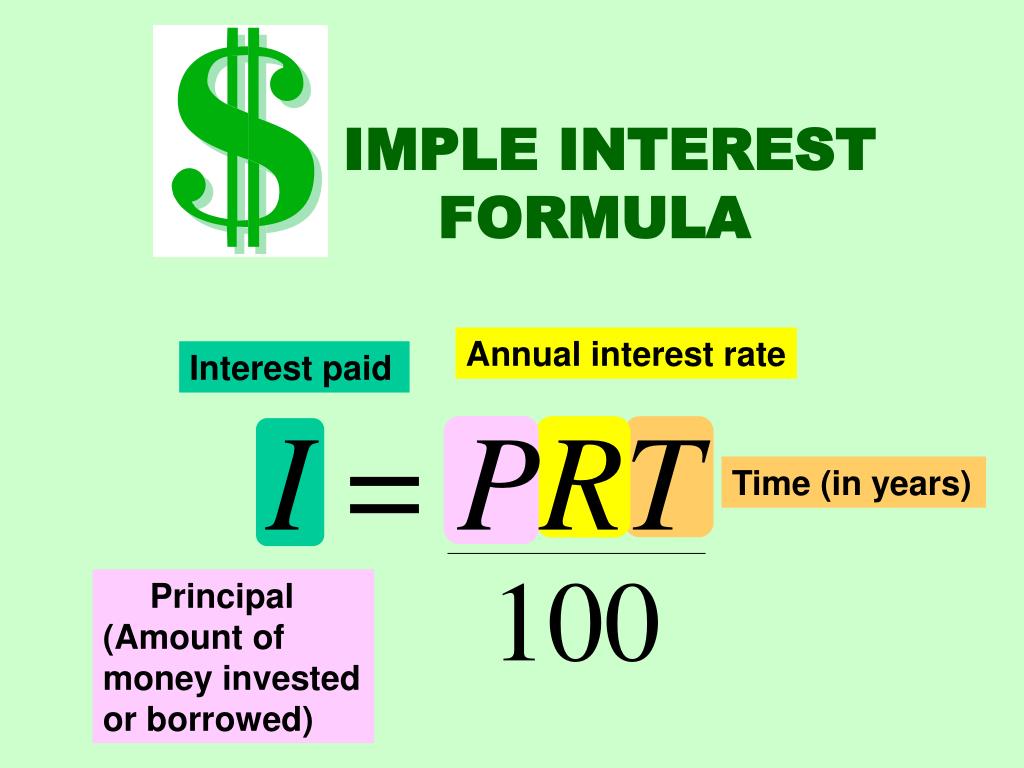

Compound interest is interest that is calculated on the principal plus the amount of interest already earned. If you are using the formula to calculate simple interest, don’t forget to add the principal if you want to know the total amount owed/saved. Simple interest is calculated as a percentage of the principal and stays the same over time.

- Anybody who wants to put their money into a compound interest account should know how to compare accounts.

- In the first method, we can directly substitute the values in the formula.

- If it is compound interest, your interest earns interest, meaning you’re earning more every time interest is paid.

- We know that simple interest and compound interest are the two important concepts widely used in many financial services, especially in banking.

- In other words, it’s more of an all-in-one term to describe investment returns that aren’t entirely interest.

A loan company charges $30 interest for a one month loan of $500. The units of measurement (years, months, etc.) for the time should match the time period for the interest rate. Compound interest is better for you if you’re saving money in a bank account or being repaid for a loan.

Financial institutions divide the year into a certain number of periods and add simple interest to an account after each period. When the interest is charged on the original amount that is lent to the borrower, it is termed as simple interest. In simple interest, the interest is charged only on the money principally lent. The amount payable at the end of the term includes the actual amount plus the interest charged on the same amount. The long-term effect of compound interest on savings and investments is indeed powerful. Because it grows your money much faster than simple interest, compound interest is a central factor in increasing wealth.

If interest accrues and is added to the balance, then it is compound. Interest that is due daily, monthly, or quarterly is better for depositors and lenders. Interest due annually is more advantageous for borrowers and savings institutions. The annual percentage rate (APR) reflects the impact of the daily compounding period on the interest rate. Lenders, including credit card companies, determine this rate and must tell you what the APR is for the financial product you’re considering. A. Compound Interest is mainly used in investments such as savings account, mutual funds etc.

The concept of compounding is especially problematic for credit card balances. Not only is the interest rate on credit card debt high, but the interest charges also may be added to the principal balance and incur interest assessments on itself in the future. Investing in dividend growth stocks on top of reinvesting dividends adds another layer of compounding to this strategy that some investors refer to as double compounding. In this case, not only are dividends being reinvested to buy more shares, but these dividend growth stocks are also increasing their per-share payouts. Compound interest is calculated by applying an exponential growth factor to the interest rate or rate of return you’re using.

This example shows monthly compounding (12 compounds per year) with a 5% interest rate. To assist those looking for a convenient formula reference, I’ve included a concise list of compound interest formula variations applicable to common compounding intervals. Later in the article, we will delve 10 characteristics of financial statements its types features and functions into each variation separately for a comprehensive understanding. Use the simple interest formula to calculate the interest gained on \(£2500\) over \(4\) years at a rate of \(6\%\) per annum. The difference between simple interest and compound interest is in the way they’re calculated.

For example, many corporations offer dividend reinvestment plans (DRIPs) that allow investors to reinvest their cash dividends to purchase additional shares of stock. In the previous example, we used annual compounding, meaning the interest is calculated once per year. In practice, compound interest is often calculated more frequently.